Loan Closings

National Escrow and Title specializes in providing support to lenders to close loans and mortgages in an efficient, error-free, and compliant manner. As an expert loan closing company, we cover all the stages of the loan closing process including ordering title reviews, readying closing statements, liaising with agents, revising the terms, etc.

Quality Loan Closing Process

Mortgage closing is an intricate process in which the lender or credit union is supposed to provide a closing disclosure document that details the entire transaction, including a breakdown of the closing costs and fees. The two things that lenders or credit unions need to be careful about at this stage of the loan process is to ensure accuracy and deliver it three days prior to the day of signing. The rigidity of the new rules and the steep costs imposed on violators, calls for a more careful approach in discharging their duties.

Assessing data integrity and documenting quality control activities during the closing stage can be a huge task for lenders. Working with a title company that understands the necessary steps, timing, cost, and legal requirements can prove to be beneficial for any lender in the closing process.

Collect Necessary Mortgage Closing Documents

We help you gather all documents needed for the mortgage closing process. These include Loan Estimates and Closing disclosure forms, title search documents, homeowner’s and mortgage insurance, appraisal and inspection reports, etc. Besides that, we also collect other documents that may be needed because of the property’s location. These include flood certificates, termite inspection certification, and water and sewer certification.

- Collect all important documents required for successful mortgage closing (inspection reports, appraisals, title documents, CD forms, title search documents, etc.)

- Collect documents related to the property’s location (water and sewer certification, flood certificates, etc.)

- Convertible to lifelong coverage that builds cash value regardless of health.

- Update the Title Search and Commitment.

Review Property Title

Our closing back-office services include one last review of the recorded legal rights of the property. We have a detailed look at the lawsuits, taxes, judgments, and liens involved. This process also involves evaluating the property’s chain of title, Title insurance policy, and plat. This is to determine if there are any listed exclusions or easements that need to be considered. After the review, we arrange the files in the right sequence to make the mortgage closing process seamless.

- Arrange the required files in the right order to facilitate easy processing

- Final evaluation of recorded legal rights

- Detailed look at the property’s chain of title

- Review of the Title insurance policy with its listed exclusions

- Review of the plat, which indicates the legal property boundaries and any records of encroachments or easements

Preparing Closing Instructions Statement

Following title review, the closing documents are reviewed for one last time for inconsistencies. We prepare the closing instructions statement and send it to the funding and post-closing department along with a copy of the Bank Note, E&O Insurance and Wiring Instructions, etc.

- Final review of the closing documents for errors, signature, and name. Additionally, reviewed are appraisal reports, flood certificates, inspection reports, homeowner’s insurance, etc.

- Prepare the title company closing instructions statement

- Deliver the closing instructions statement to the funding department, along with copy of the bank note(s), wiring instructions, and E&O insurance

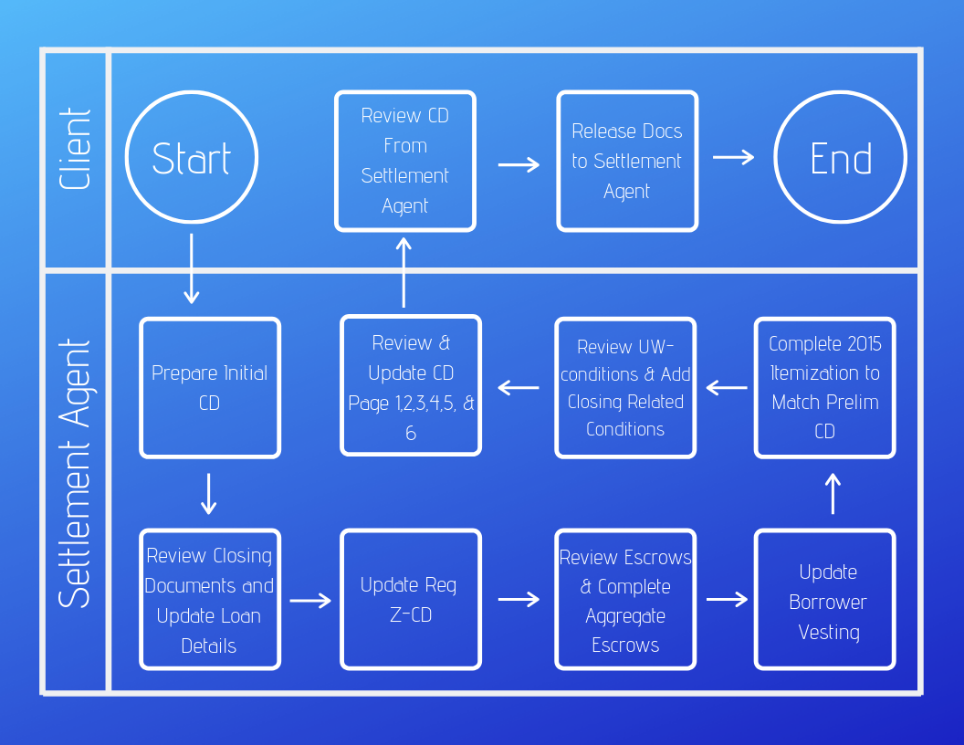

Working with Settlement Companies

We work on your behalf with third party companies to evaluate taxes and fees and even procure the escrow agreement. We also pass on instructions to agents to determine how the mortgage funds are distributed at mortgage closing.

- Reach out to third party companies for fee sheets

- Draft or obtain the escrow agreement

- Evaluate taxes and fees

- Send lender instructions and confirm settlement with agents

- Determine how funds will be distributed at closing

Preparing and Dispatching Important Mortgage Closing Documents

We help lenders prepare and dispatch closing documents as required by state and federal law. These include the loan estimate, the closing disclosure, the notice of the right to rescind, and the initial escrow statement. In keeping with the rules, we assist and provide closing disclosures to be sent three business days before the signing of loan documents. We also ensure that we follow up with all parties to the transaction to close mortgage loans within certain time constraints.

Our Closing Service Steps

As part of the pre-closing audit, we review the order and make note of any potential delays in closing the transaction. During this stage we make sure that the purchase offer has been acknowledged, Lender has received all items from borrower to close, and the proposed home has been approved post-inspection, if necessary.

OUR END-TO-END MORTGAGE CLOSING SERVICES

| Prepare the Prelim HUDs (settlement statements) and Final HUDs based on the Closing Instructions/Fee Sheets/Invoices

|

Review all open conditions and ensure all underwriting conditions are signed off prior to closing

|

Prepare the document order form and fee sheet and fax/email to the Loan Officer (or loan processor) for approval

|

| Closing document preparation and review

|

Submit signed loan package to lender and with copy of cleared lender conditions

|

Obtain closing protection letters and wiring instructions

|

HUD\CD Statement Preparation

The HUD Settlement Statement or Closing Disclosure Statement is used to itemize all charges imposed on a buyer and requires the approval of the lender and if necessary, the buyer’s attorney. We help you include all the necessary information in the specified format and style, while maintaining regulatory compliance.

- Assist Lender to ensure 100% regulatory compliance

- Review all the borrower’s loan terms (i.e. interest, prepayment penalties, variable rates, escrow requirements, principal amount, etc.) to adequately document the necessary statements

- Assist in reviewing and signing settlement statements

WHY OUTSOURCE LOAN CLOSING SERVICES?

By outsourcing your mortgage closing process to us, you receive the following benefits:

- Accuracy in the reviewing of closing documents

- Expert group to deal with regulatory requirements

- Standardized and automated back-office services for mortgage closing

- Seamless communication and highly transparent operations

- 100% data confidentiality and privacy

- Flexible staffing model

- Meeting new TRID regulations pose a big challenge for lenders. The key to lessening the complexities involved in correctly preparing and assembling the required mortgage closing documents is an expert third-party partner. National Escrow and Title has the know-how to incorporate new disclosures into the daily flow of loan origination, loan processing support and loan closing.